Join ARAC Grant Advisors for a rare opportunity to connect with a local tax professional, Ask Anna Tax, to learn more about how grant awards and other art-sourced income are reported on your tax return, alleviating surprises come April 15 and beyond as you embark upon your creative career! This workshop will cover the rules and issues involved in filing taxes for individuals who produce works within the creative economy and get paid for their craft. We’ll cover the essentials across a variety of artistic disciplines – tax deductions, record keeping, grant income considerations, setting up your books, and tax planning – for filing your federal and state tax returns.

Note: Out of respect for the privacy of attendees and to ensure the most up-to-date information is provided, this session will not be recorded. Slides will be available for attendees to reference. Stay tuned for future tax workshops in the fall!

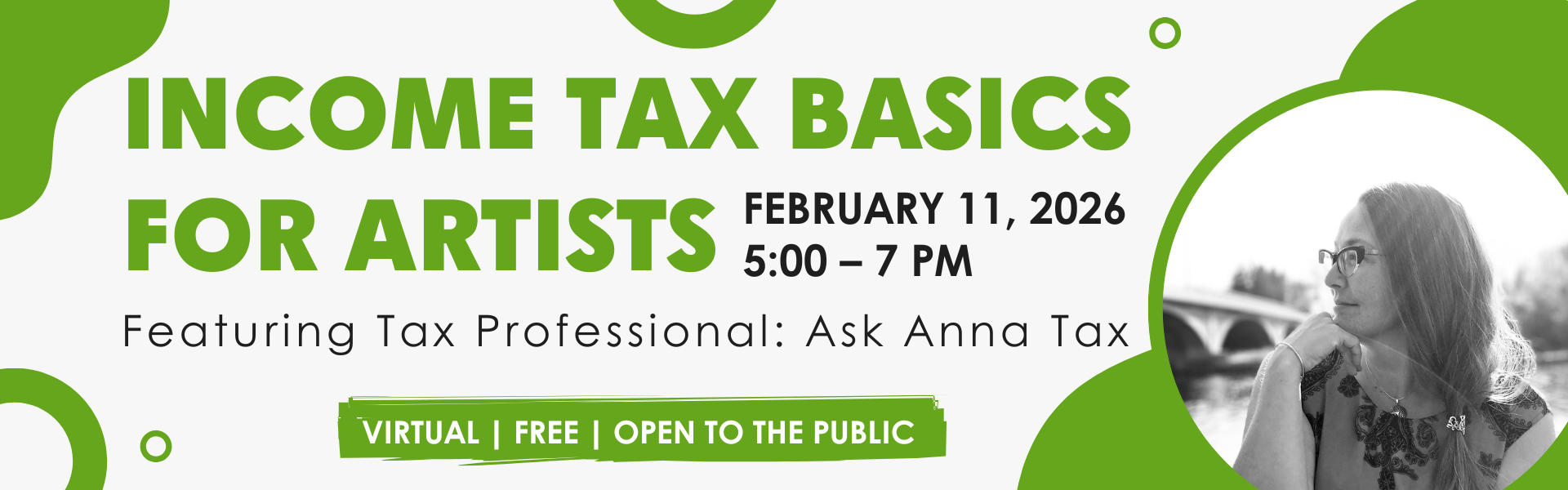

February 11, 2026

5:00 – 7 PM

FREE, VIRTUAL, OPEN TO THE PUBLIC

Meet the Presenter: Ask Anna Tax

I went to school for Speech Pathology, and then I fell into accounting – I know, bizarre path to doing taxes. Turns out I’m a numbers nerd, but my background helps me break down complex tax rules into easy-to-understand presentations. I have more than 20 years of experience in the tax world, and I LOVE learning about and sharing tax savings strategies that help keep dollars in the pockets of my clients. The focus of Ask Anna Tax is to provide tax returns and advisory services to small business owners, and my heart and soul belong to women- and queer- owned businesses.

Website: https://www.askannatax.com/

Contact Email: anna@askannatax.com

Facebook – Anna Dilley, EA

Instagram – askannatax

BlueSky – AskAnna